Homebuyer Dream Program

Starting July 2019, eligible home buyers may receive up to $14,500 through participating financial institutions. Funds may be used for down payment and/or closing costs. Eligible participants:

-

Complete a homebuyer counseling program

-

Are first-time homebuyers

-

Meet household income guidelines based on where you purchase

-

Purchase a home in New York

-

Purchase an eligible property

-

1-4 family; or a manufactured home permanently affixed to a foundation

-

Be under contract to purchase a home at time of application

-

Show evidence of a minimum of $1,000 equity contribution

-

Own and occupy the home for 5 years.

-

You must earn less than 73,000 a year family income for a family of three.

-

Sullivan County NY income caps at 73K

-

This is a credit. The money is yours.

-

This can be used on an FHA, VA, USDA or Conventional loan.

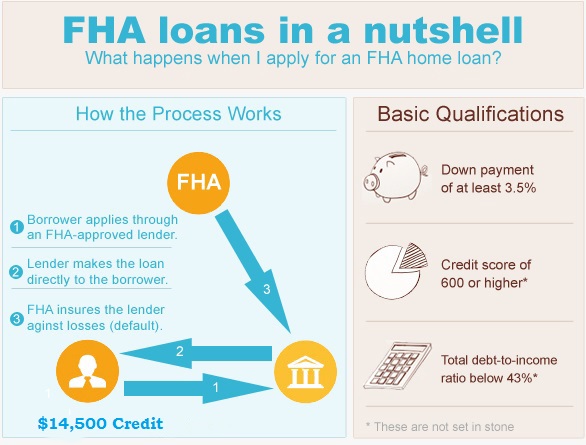

FHA loan is one of your options

FHA loans are issued by private lenders, including banks, credit unions and online lenders — but they’re guaranteed by the Federal Housing Administration, a government agency. That guarantee, which protects lenders against losses if you default, means borrowers who may not have great credit or who don’t have a big down payment have an easier time qualifying.

A lot of first-time homebuyers opt for FHA loans, but you don’t need to be a first-time buyer to get one. (However you do need to be a first time home buyer to receive the credit.) Any borrower can benefit from the easier qualifying process, as long as you’re buying a house or a multifamily residence where you’ll live most of the time. You need a credit score of at least 580, and you will need to put down 3.5%. Private mortgage insurance (PMI) will also be needed.

So if you have a credit score higher than 580, and make less than 73K a year, with interest rates at around 4%, and 15K in closing costs covered, it really has never been cheaper or easier to buy a house. Call me today for more info on how I can get you out the endless cycle of renting. You can buy a house with less money than what most landlords are asking for. (First month, last month and one month security) Click on the link on this page to search for houses in that FHA sweet spot in Sullivan County (110K to 250K) And then give me a call. I can help you with all the details.

I would like info on this program

My name is Hector Torres I’m working with Rocket mortgage I need a program like this for my closing cost. I have saved already 7000 for my new home.

I’m looking at homes in Sullivan County and looking for assistance with down payment assistance.

Please give more information

Good evening, I would like more information on this program.

Thank you